| It

is far better to over-prepare for a crisis that

never gets bad than it is to under-prepare for a

long crisis that overwhelms you. The sooner

you (over-) prepare, the better.

Begin now to

economize, downsize, and focus on love, happiness

and simple goodness. Do a little more each

day as fast as possible. Read every “How

to Economize” guide you can find on the internet

(or public library) and do whatever you can.

If your

JOB is vulnerable

in a severe economic depression (say, you sell

luxury toys), then (retrain and) change jobs to

work for:

- an

essential industry (utility company, food

production, health care, post office, police,

military, prisons, etc.)

- the

government (federal best, then state or local)

or selling things to the government (like

military or GSA equipment, etc.)

- essential

professions in health care, security,

teaching, engineering, and computers (versus

non-essential legal work, real estate, etc.)

- companies

in south Florida or along the Mexican border

If

your HOME is vulnerable

in a severe economic depression (if your monthly

mortgage payments exceed 25% of your gross income

and/or your mortgage balance exceeds 1/3 of your

current home value), then sell your home (a fire

sale if you must) and move into a less expensive

home or apartment in a lower cost of living area

(warm South is better than cold North). Otherwise

share your house expenses with other family

members who move in, or sublet rooms if possible,

or shut off most of the house and live in a small

area to conserve on heating and/or A/C. Grow a

large vegetable garden if you can. Move your

business into your home if possible.

If your

INVESTMENTS are vulnerable in

a severe economic depression (bank accounts,

stocks, bonds, T-bills, speculative real estate,

non-essential business ventures, etc.), then

change your investment strategies and tactics. “Put

only one of your investment eggs in each of a

dozen different baskets” to spread out your base

and lower your risk. For example, gold, silver and

platinum (coins, bars, jewelry, shot) are all

precious metals, so they are actually just one

investment “basket.” Stocks are another

basket. Bonds another; T-bills another; real

estate another, business ventures another, foreign

currencies another, foreign investments another,

etc.

Astrology

can provide you with a detailed plan of action.

You can learn your best days to invest and to make

wise, beneficial financial decisions. You can also

learn IF your broker, financial advisor, doctor,

lawyer, contractor, etc. are beneficial or

detrimental to your goals.

Astrologers who specialize

in financial astrology can even recommend specific

markets, individual companies, stocks, bonds, and

other investment vehicles which are most

profitable for you. Such advice has a maximum

probability of 60-70% success and should be

combined with information and advice from other

professional sources to minimize your risk of

loss.

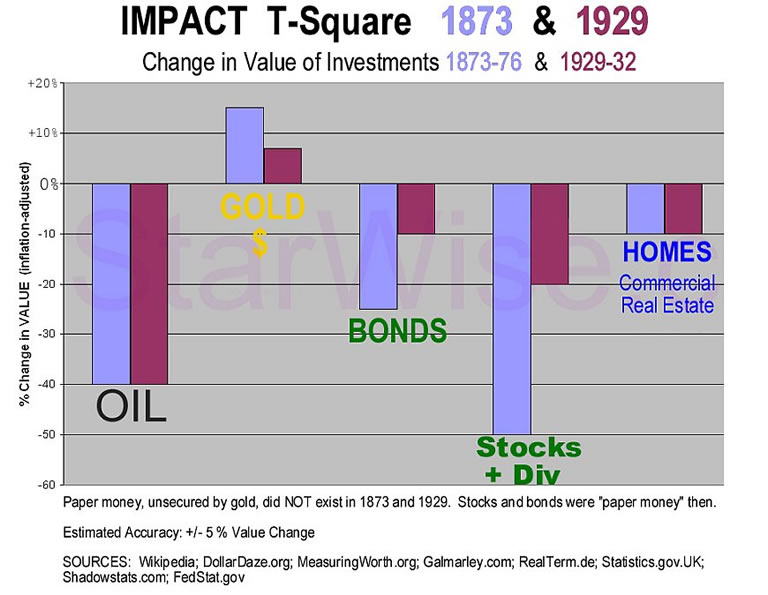

The last two T-square

patterns (1929-32 and 1873-76) profoundly impacted

the real VALUE (purchasing power inflation

adjusted) of wealth and investments, not to

mention the unemployment, poverty, chaos and war

that ensued. Precious metals (gold, silver)

enjoyed net real increases in value.

Tangible essential items, like homes, lost only

modest value. Paper investments (stocks, bonds)

and non-essential items and commodities (oil) lost

the most value.

However, the past will

not be an exact example of what will occur in

2010-13 since important differences exist between

then and now. For example, oil in 1873 and 1929

was not the critical, depleting resource it is

today. Major new challenges exist now due to world

population, pollution and resource depletion.

Plus, paper money, whose

value is not based on reality (gold), but on

government fiat (debt), is now a big portion of

world financial liquidity. The paper money in use

today has actually only existed since the

1970's when Nixon ended the dollar-to-gold

standard. Throughout history, such paper money has

never survived more than a few decades.

In 1929 about 1/2, and in

1873 about 2/3, of the economy of the USA and

Europe was solidly based on essential core items

like food, shelter, etc. which cushioned the

depression. Those past economies only collapsed

down to the large core before recovering.

Especially in 1873, non-essential items were a

luxury for the rich. Thus, stocks and bonds barely

fell in the Panic of 1873, because the rich could

ride out the depression for a while.

In sharp contrast, nowadays

only about 1/4 of the US and Europe economies are

based on essential core items. These

"virtual" economies are mostly based on

intangible items, such as debt, paper money,

loans, stocks, bonds, futures, insurance,

derivatives, etc. The floating value of such items

not only can change quickly, but has little real

worth in a crisis.

These factors suggest that

the developed world will suffer much worse

problems in 2010-13 than it did in past T-square

crises. It is prudent to prepare for the worst

while hoping for the best.

If your

HEALTH is vulnerable

in a severe economic depression (due to your age,

costly medications, special treatments, etc.),

then discuss your concerns about your future care

with your doctor or health advisor. Perhaps you

should move near to a hospital, nursing home or

trusted care giver. Perhaps you should order

several years of non-perishable medicine in

advance to stockpile while it is available and

affordable. Adopt extra healthy habits now.

IF your

SAFETY is vulnerable

in a severe economic depression (due to your age,

your race/religion being victimized as a scapegoat

target for the crisis, or rising crime in your

neighborhood against the “wealthy” or the “weak”,

etc.), then consider moving near to a police

station, getting a big trained dog, and learning

professional advice on how to increase your

personal and family’s safety in your home, car,

school, at work and in general. Given that there

is safety in numbers, consider living together

with friends, family or others who share your

outlook. Perhaps never go out in public at night

alone. Avoid trouble areas completely. Being

obviously different than your neighbors is unwise,

as is excess isolation.

Hide your

wealth (but not under your mattress). Appear

somewhat poor and average, but alert. Make

yourself and your life style as inconspicuous as

possible. Wear ordinary, low-cost clothes when you

go out (like a low quality raincoat hiding your

nice clothes underneath), wear no rich jewelry,

UN-glamorize your home, put mud on your new car

and cheap seat covers inside. Public attention due

to your wealth, your controversial public office

or behavior, your conspicuous consumption or

extravagant lifestyle is unwise.

Realize that

arming yourself is usually counter-productive

against thieves. Most gun owners are shot with

their own weapon, because the thief finds your gun

first before you come home and surprise him. He

then shoots you in “self-defense” to make his

escape.

If you

have SPECIAL NEEDS AND CONCERNS

in a severe economic depression for whatever

reason, seek out professional advice and

information on your situation. Have faith that

your love, happiness, and simple goodness will

triumph in the end. Then do every reasonable thing

possible to make this true. |